WeChat Quietly Mimics Xiaohongshu as Tencent Strengthens Its Core Strategy

In an unexpected yet strategic move, WeChat has been quietly introducing a new content feature, closely resembling the popular Chinese lifestyle platform, Xiaohongshu (Little Red Book).

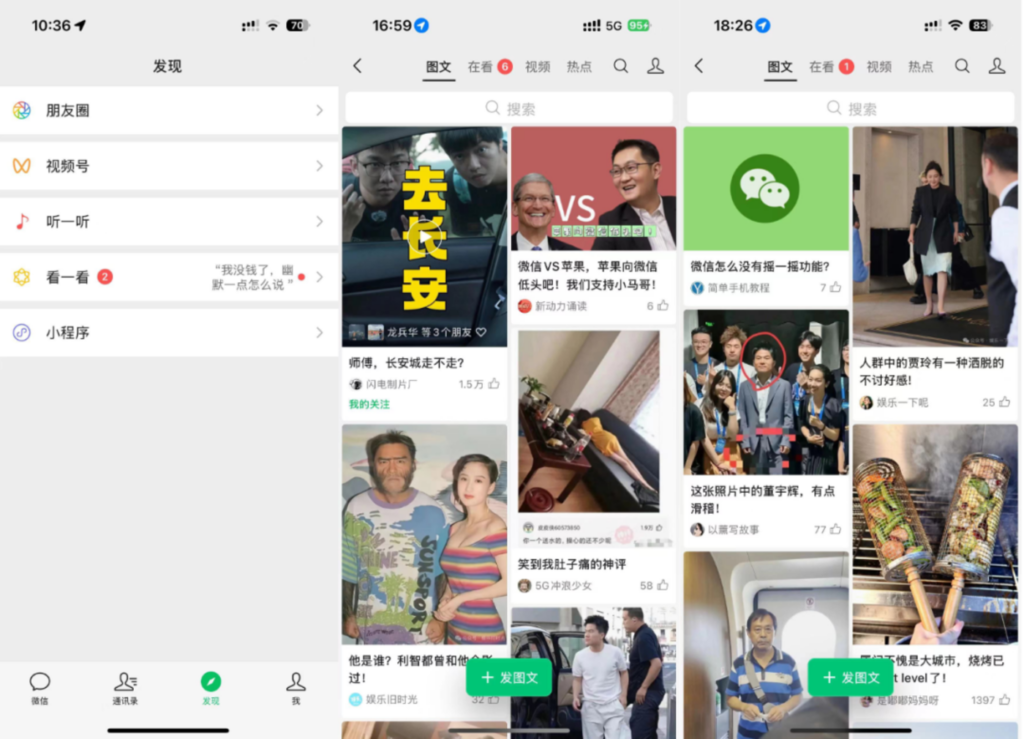

Through subtle UI adjustments, primarily using red dot notifications, WeChat has begun channeling users into a dual-column, image-text format that feels strikingly similar to Xiaohongshu’s interface.

This development, which is currently undergoing grey testing, indicates a shift in Tencent’s broader strategy to diversify its content offerings and tap into new audience segments.

For many users, clicking on the familiar notification initially leads them to articles shared by friends but increasingly reroutes them to a dual-column layout showcasing various content types, from videos to trending topics.

This deliberate yet understated change hints at WeChat’s ambition to capture the growing market for social-driven, lifestyle content—a space where Xiaohongshu has excelled. By leveraging its vast user base, WeChat seems poised to cultivate a new habit among its users, subtly steering them towards this content.

A Strategic Evolution for WeChat

WeChat’s move into this space isn’t entirely surprising. For some time now, its public accounts have been offering image-heavy, text-light content that aligns with Xiaohongshu’s style.

What is different today is the launch of a dedicated “container” for such content, effectively closing the loop and creating what can be seen as an internal version of Xiaohongshu.

With an already robust ecosystem of public account creators who generate image-text content, WeChat has all the resources to support this dual-column format. The only missing piece is user engagement, which Tencent is actively fostering through its red dot notification system.

By seamlessly integrating Xiaohongshu-like features, WeChat aims to replicate the success of other content-driven platforms like Douyin (TikTok in China), focusing on growing its in-house ecosystems.

This strategic evolution aligns with Tencent’s overarching goal to capitalize on its content ecosystem. In 2023, WeChat’s video platform (Video Account) boasted 9 million monthly active users (MAUs) and 4.5 million daily active users (DAUs), with average daily usage exceeding 50 minutes per user, approaching Douyin’s 7.6 million DAUs.

Monetization and Commercial Ambitions

Tencent has been sharpening its focus on high-quality growth, as evidenced by the impressive 80% year-on-year (YoY) increase in ad revenue from Video Account in the second quarter of 2024.

WeChat’s integration of social, e-commerce, and content features positions it to tap into a diverse range of revenue streams, including advertising and digital payments.

WeChat is also making strides to improve its e-commerce capabilities, with its Video Account continually filling gaps in commerce integration, demonstrated by its growing GMV (gross merchandise volume) and user engagement.

Beyond social and e-commerce, Tencent has extended its ecosystem to financial products. WeChat’s “Fenfu” (pay later) feature, for example, has quickly gained traction, with credit balances expected to grow from several billion RMB at the beginning of 2024 to over 1 trillion RMB in the near future.

Integrated directly within the WeChat payment interface, Fenfu is now one of the most accessible loan products on the platform.

Keep reading with a 7-day free trial

Subscribe to China Innovation Watch to keep reading this post and get 7 days of free access to the full post archives.