Tencent Key Insights from 2024 Results

Tencent ramped up AI investments (+221% YoY), fueling growth in AI apps and enterprise services. WeChat Video Accounts surged in engagement, boosting ad revenue (+60% YoY).

Tencent Holdings has unveiled robust annual results for 2024, achieving significant revenue growth driven by substantial investments in artificial intelligence (AI) and digital services.

These strategic investments are poised to bolster the company's long-term positioning in China’s rapidly evolving digital economy, underscoring critical insights for business executives, investors, and industry analysts tracking tech innovations in the Chinese market.

Strong Financial Performance Powered by AI Initiatives

Tencent reported total annual revenues of RMB 660.3 billion (USD 91.9 billion), an 8% increase year-over-year (YoY).

Gross profit surged by 19%, reaching RMB 349.2 billion (USD 48.6 billion), driven by enhanced monetization strategies and AI integration across its platforms. Non-IFRS operating profit notably grew by 24% to RMB 237.8 billion, illustrating Tencent’s successful shift towards high-quality, sustainable revenue streams.

This robust financial performance highlights the effectiveness of Tencent’s AI-driven enhancements in key revenue segments:

Value-Added Services (VAS): Annual VAS revenues rose by 7% to RMB 319.2 billion, driven by significant growth in evergreen games and subscription-based content.

Marketing Services: This segment witnessed remarkable growth of 20% YoY, reaching RMB 121.4 billion, bolstered by AI-powered ad targeting and content creation.

FinTech and Business Services: Revenues grew moderately by 4%, indicating stable demand in financial services and enterprise solutions despite GPU allocation constraints.

Strategic AI Investments Elevate Consumer and Enterprise Offerings

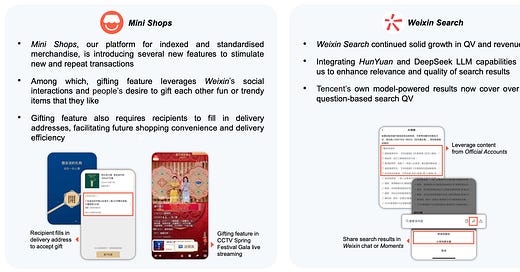

Tencent’s strategic investment in the HunYuan (HY) Foundation Model is central to its competitive advantage. Since accelerating AI investments in 2023, Tencent has significantly enhanced internal and consumer-facing applications such as Yuanbao and WeChat, driving exponential growth in user engagement.

Yuanbao alone saw its daily active users (DAU) surge more than twenty-fold in early 2025, making it one of the top AI-native applications in China.

Tencent’s AI initiatives also transformed enterprise services:

Cloud Services: AI cloud revenue approximately doubled YoY, though GPU constraints temporarily limited external growth. Additional GPU acquisitions are expected to significantly boost cloud revenue in 2025.

Enterprise Productivity: Products such as Tencent Meeting and Tencent Docs now feature advanced AI-driven functions, greatly enhancing user productivity.

Innovation in Gaming and Entertainment Bolstered by AI

The integration of large language models (LLMs) and machine learning significantly boosted Tencent’s gaming and entertainment sectors:

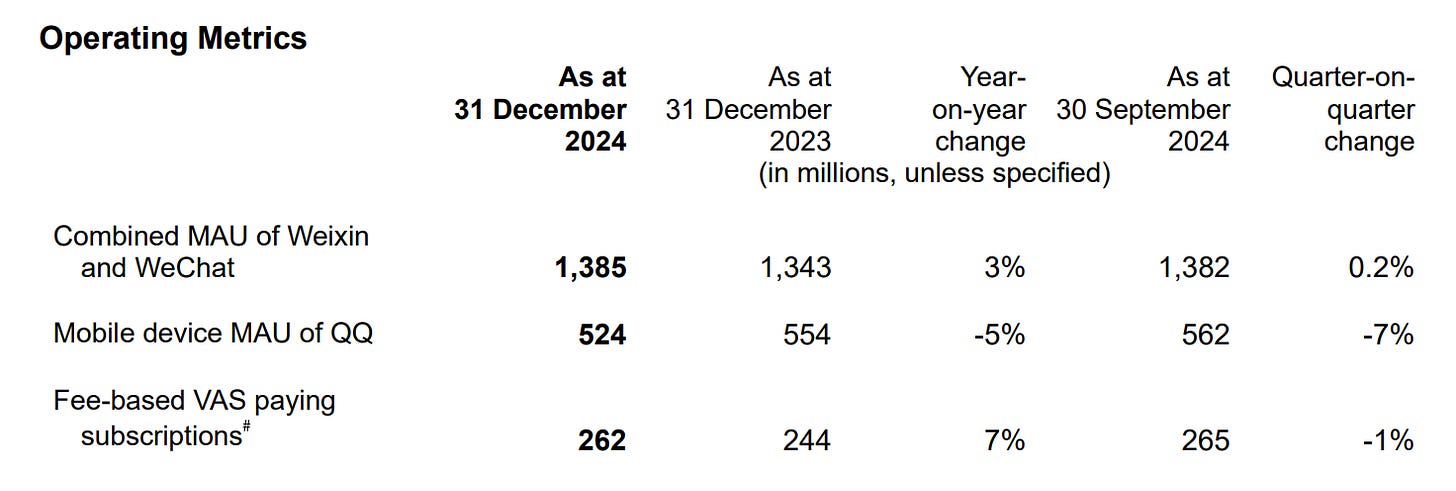

Gaming: Evergreen titles like "Honour of Kings" and "VALORANT" showed robust revenue growth, with new releases such as "Delta Force" and "Path of Exile 2" showing potential for evergreen status. AI-powered content generation and optimization further increased user engagement and monetization.

Video and Music: AI-driven algorithms improved content discovery and personalization, solidifying Tencent Video’s leading position with 113 million subscribers and Tencent Music’s market leadership with 121 million subscribers.

Shareholder Returns and Sustainability

Tencent significantly enhanced shareholder value, repurchasing shares worth approximately HKD 112 billion—more than double the previous year—and proposing a 32% increase in its annual dividend to HKD 4.50 per share for 2025. This financial stewardship reflects Tencent’s confidence in sustained, AI-driven growth.

Additionally, Tencent strengthened its sustainability efforts, enhancing data center efficiency and renewable energy adoption, moving steadily towards carbon neutrality.

Its digital philanthropy initiatives reached over 280 million users, connecting with thousands of charitable organizations, thus demonstrating corporate responsibility alongside business success.